Maximizing your credit score rating, furnishing accurate details for the duration of the application, and judicious number of the lender can bolster the chance of securing a $seven-hundred mortgage.

Short-term alternatives cater to people searching for swift repayment to attenuate interest, While for a longer period terms suit Individuals needing decreased every month payments to suit their finances.

Alternatively, presenting gives from competing lenders may well serve as leverage in discussions, probably leading to more useful premiums.

This approach boosts 1's capability to cover bank loan repayments, incorporating a layer of economic balance.

Credit Builder Additionally membership ($19.ninety nine/mo) unlocks eligibility for Credit rating Builder As well as financial loans as well as other exceptional solutions. This optional present is not a Pathward goods and services. A delicate credit pull will probably be carried out which has no impact to the credit rating. Credit history Builder As well as financial loans have an annual proportion fee (APR) ranging from five.99% APR to 29.99% APR, are created by both exempt or point out-certified subsidiaries of MoneyLion Inc., and need a loan payment In combination with the membership payment. The Credit score Builder In addition bank loan may, at lender’s discretion, demand a portion of the financial loan proceeds to be deposited right into a reserve account taken care of by ML Wealth LLC and held by Drivewealth LLC, member SIPC and FINRA.

TriceLoans is your go-to Option if you require little own financial loans for $700 dollars or maybe more. They collaborate with a number of approved bank loan providers, so your options aren’t limited to one particular.

Opposite to payday financial loans, an installment mortgage characteristics an extended repayment time period, ordinarily Long lasting from ninety times around 24 months. This permits for a far more workable repayment approach, which is outlined inside the mortgage arrangement.

It’s attainable to receive swift funding for modest loans, nevertheless it’s important to take into consideration fascination costs, bank loan phrases and costs prior to making a decision. Whilst lots of lenders don’t give compact loans less than $1,000, some credit history unions, on the internet lenders, bank loan apps and payday lenders do.

Finding your palms on the $700 payday personal loan may appear to be hard, particularly if you’re worried about your money previous. But there are ways to increase your probabilities of getting authorised.

Averting even further credit card debt for the duration of mortgage repayment is a significant element of accountable economic management. Helpful tactics contain:

A $700 dollar personal loan with month to month payments: Installment financial loans tend to be more structured, permitting you to repay above a website established period. This kind of financing can stretch repayment in excess of quite a few months, rendering it a far more manageable alternative.

To qualify for almost any credit rating, you will need to display your capacity to repay. This might suggest displaying proof of work, money, and banking account. Lenders need to know it is possible to take care of the duty.

Agreements between acquaintances or kinfolk might not desire official repayment schedules. This route gets rid of credit checks, making it more rapidly And maybe more accessible for the people with weak credit history histories.

To speed up your chances of staying funded, it can help to apply on a weekday involving 9AM and 5PM and be available to answer any e-mail or calls out of your picked out lender.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Marcus Jordan Then & Now!

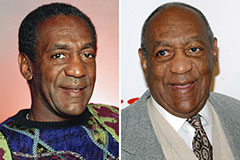

Marcus Jordan Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!